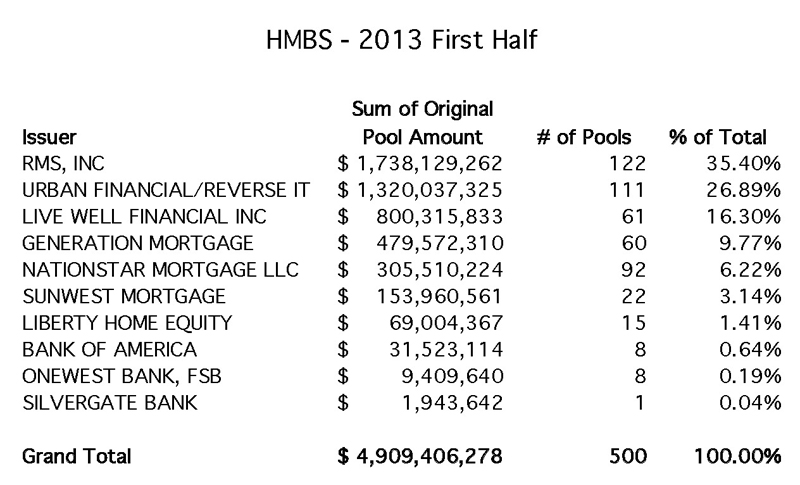

Ten issuers issued exactly 500 HMBS pools in the first half of 2013, totaling $4.909 billion. 256 of these HMBS pools, totaling just over $2.5 billion, were issued in the second quarter, marking a 4% increase over the first quarter of 2013. RMS continues to be the market leader, issuing more than 35% of all pools in the first half of 2013, with 122 pools totaling $1.738 billion. Urban Financial retained its position as the #2 issuer with 111 pools totaling $1.32 billion, followed by Live Well, Generation Mortgage, and Nationstar, with $800.3 million, $479.6 million, and $305.5 million issued respectively. The number of issuers was unchanged from the first quarter.

The 500 pools issued in the first half of 2013 is more than the total number of pools issued in 2009, 2010, or 2011, and almost as many as the 628 pools issued in all of 2012. The higher number of pools represents the increasing percentage of “tail” issuances as the amount of HMBS outstanding increases, producing more and more Additional Amounts eligible for certification from borrower draws, MIP, and other servicer advances. In the first half of 2013, HMBS issuers produced 11.2% of all HMBS issued by dollar amount since the program’s inception in 2007, but 21.7% by number of pools.

Fixed rate issuance dominated (perhaps for the last time), accounting for $3.3 billion, over 67% of the total.

New View Advisors compiled this data from publicly available Ginnie Mae data as well as private sources.