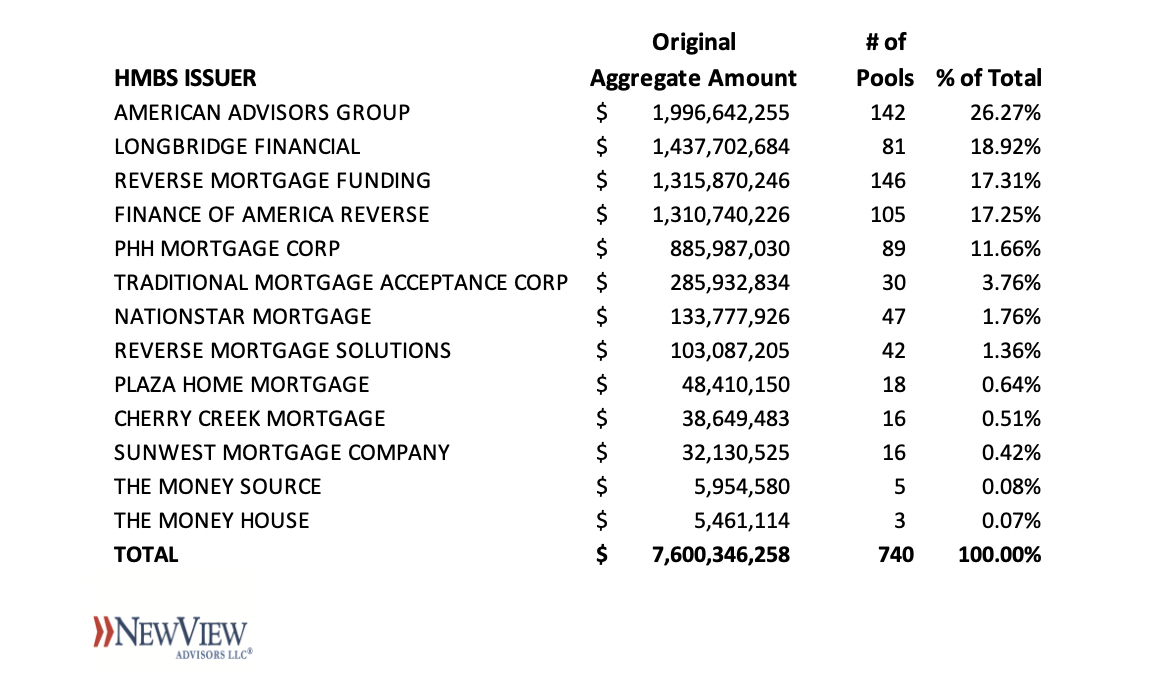

AAG maintained its #1 HMBS issuer ranking through three quarters of 2020 with nearly $2 billion of issuance and 26.3% market share. Longbridge leapfrogged into second place for the quarter with $1.44 billion issued and 18.9% market share. RMF dropped to third, with $1.32 billion issued and 17.3% market share, and FAR was fourth with $1.31 billion issued and 17.3% market share. PHH Mortgage fell to fifth, with $886 million and 11.7% market share. These five issuers continue to account for 91% of all HMBS issuance. There were 12 active HMBS issuers in 2020Q3.

2020Q3 saw $3.16 billion of HMBS issued, up from second quarter’s $2.35 billion and first quarter’s $2.09 billion. With HMBS capital markets recovered from the Coronavirus pandemic, and HECM origination volume up, 2020 HMBS issuance is on trajectory for close to $10 billion. As mentioned in our previous blog, time will soon tell how Ginnie Mae’s decision to end LIBOR as an index for new HMBS pools backed by first participations will affect volume.

New View Advisors compiled these rankings from publicly available Ginnie Mae data as well as private sources.

Leave a Reply