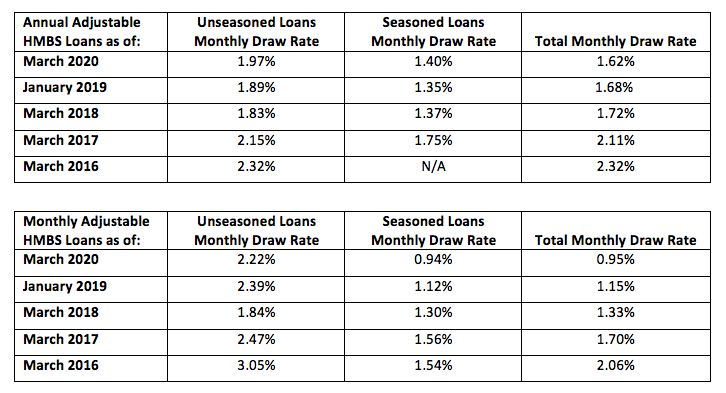

HMBS investors and issuers feared big draws in March. They worried that the widening crisis would panic reverse mortgage borrowers into a “run on the bank” mentality resulting in large draws on HECM Lines of Credit. This would increase the capital demands on HMBS issuers at a time when their own financing liquidity was decreasing. However, the latest GNMA data show that this was a dog that didn’t bark. Draw rates for March 2020 stayed well within historical averages, just as they did during the 2008-2009 Great Recession. Here are March 2020’s draw numbers, compared to past data, including January 2019 (our last published Draw Index) and March data from prior years:

In the table above, the index value is expressed as a monthly draw rate, equal to the amount of Line of Credit draws taken in any given month, divided by the Total Line of Credit Amount available at the beginning of that month. The index applies only to loans with a Line of Credit feature. Unseasoned Loans are defined as loans originated no more than 2 years ago, and Seasoned Loans as loans originated more than 2 years ago. Draws tend to be higher in the early years of a loan, then decline to a stable plateau as the loan matures. The draw amount for many HECM loans is restricted in the first year. As a result, the overall draw rate jumps materially in month 13 (a complete report showing draw rate by loan age month is available by subscription).

New View Advisors compiled this data from publicly available Ginnie Mae data as well as private sources.

Leave a Reply