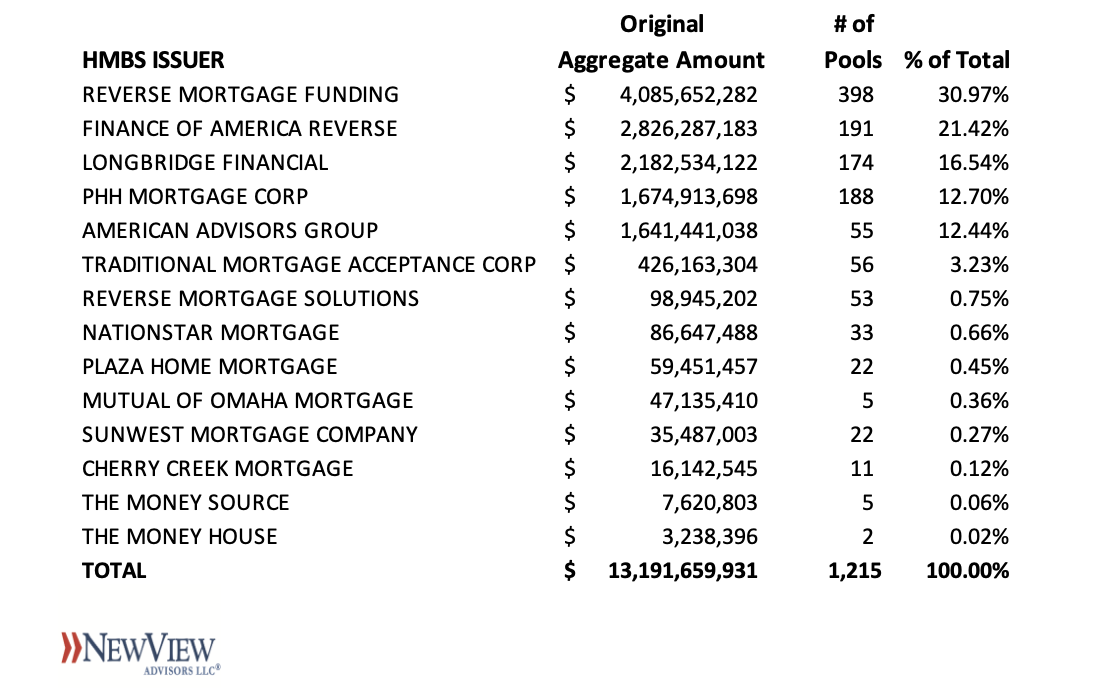

Reverse Mortgage Funding became the #1 HMBS issuer in 2021, with $4.09 billion issued and near 31% market share, due in part to its acquisition of AAG’s HMBS portfolio during the quarter. Ginnie Mae gives full issuance credit to the surviving/purchasing HMBS Issuer. FAR remained in second with $2.83 billion issued and 21.4% market share, Longbridge was third with $2.18 billion issued and 16.5% market share, and PHH was fourth with $1.67 billion issued and 12.7% market share. AAG fell to fifth, rounding out the Top Five, with $1.64 billion and a 12.4% market share. Giving credit to AAG for its full-year book of business, AAG annual issuance volume would have been approximately $4.23 billion.

Once again, these same five issuers accounted for 94% of all HMBS issuance, consistent with past performance. There were 14 active HMBS issuers in 2021, though Nationstar and The Money House did not issue in the fourth quarter. Expect Nationstar to drop from the League Tables in 2022 as they exited the business in December.

2021Q4 saw $3.91 billion of HMBS issued, up 13% from last quarter’s $3.45 billion and the fourth consecutive quarterly issuance record. As mentioned in many of our previous blogs, $13.19 billion of HMBS issuance in 2021 easily surpassed 2010’s previous record $10.8 billion, a time when Principal Limits were high and Financial Assessment non-existent.

New View Advisors compiled these rankings from publicly available Ginnie Mae data as well as private sources.

Leave a Reply