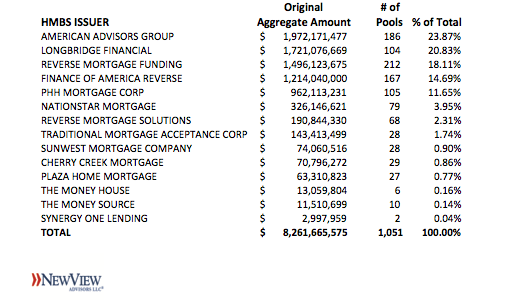

AAG kept its frontrunner HMBS issuer position throughout 2019, ending the year with $1.97 billion of issuance and 24% market share. It’s worth noting AAG’s issuance totals are all new originations and tails, with no highly seasoned pools issued. Longbridge finished in second place with $1.72 billion of issuance and 21% share, including more seasoned HMBS issuance in Q4. RMF stayed in third with $1.50 billion issued and 18% market share, which includes issuance assumed from the Live Well Financial bankruptcy. FAR was fourth with $1.21 billion issued and 14.7% market share, and PHH Mortgage Corp placed fifth with $962 million and 11.7% market share. These five issuers accounted for 89.2% of all issuance, inching closer to the Top-5 concentration high of 91% at year-end 2018. There was no change in rankings order from Q3, and all 14 HMBS issuers were active during the quarter.

2019Q4 saw $2.28 billion of HMBS issued, down slightly from Q3’s $2.33 billion, but on the upward trajectory seen all year. Nonetheless, at $8.26 billion, annual industry volume was off almost 14% from a year ago. Total HMBS issuance in 2018 was $9.58 billion.

New View Advisors compiled these rankings from publicly available Ginnie Mae data as well as private sources.

Leave a Reply