HMBS issuance increased for the first time in three years, tracking the slightly higher originations of 2013 and an increase in “Tail” securitizations. HMBS pools totaling nearly $9.6 billion were issued in 2013, up from $8.5 billion last year but 10% below 2010’s record $10.7 billion. However, the 1,023 issues shattered the previous record of 628 set last year. HMBS issuers sold nearly 400 “tail” pools in 2013. These tails are participations in previously securitized HECMs, and are created by excess interest and “Additional Amounts,” such as line of credit draws and Mortgage Insurance Premiums (“MIP”).

For a reverse mortgage industry beset by financial and political pressures, the annuity-like profits from tail issuance are a stabilizing and beneficial feature during these dog days. Tail issuance can be profitable because the HMBS issuer effectively lends the Additional Amounts at par, and can sell them in the form of HMBS Tails, usually at a premium. The excess interest portion is even better: its accrual creates an HMBS Tail without any additional cash outlay. The HMBS issuer effectively monetizes excess interest on their non-defaulted HECMs every time they issue a tail pool. A single pool can throw off profits to the issuer over a period of several years, although the premium will tend to decline over time as the underlying HECM loans approach maturity.

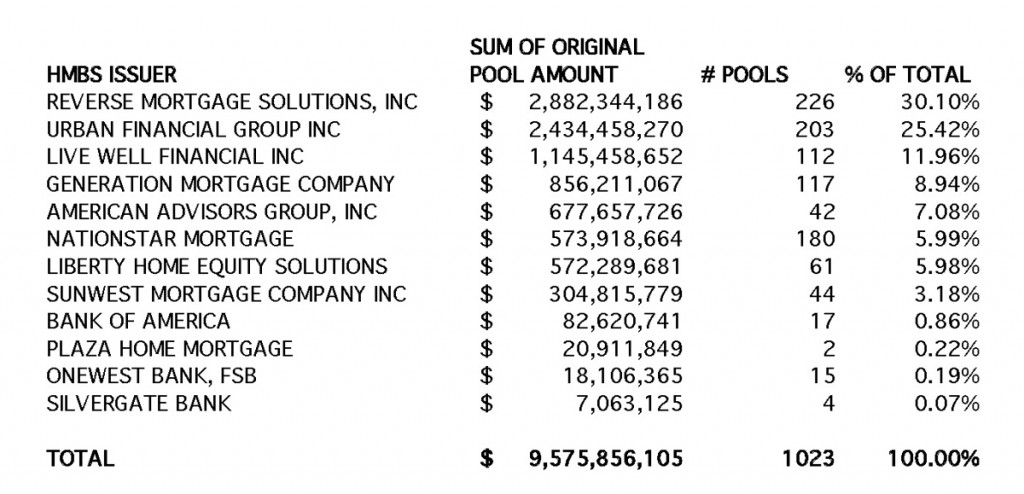

For 2013, RMS was once again the top HMBS issuer, issuing 226 pools totaling nearly $2.9 billion. RMS was followed by Urban Financial, Live Well Financial, Generation Mortgage and AAG, issuers of approximately $2.4 billion, $1.1 billion, $0.9 billion and $0.7 billion, respectively. AAG, Liberty, and Plaza Mortgage all joined the ranks of HMBS issuers in 2013. Overall, 12 firms issued HMBS in 2013, although a few of these are legacy issuers that do not currently produce or purchase new HECM production.

Of the $9.6 billion in 2013 issuance, $4.5 billion was fixed rate, representing a 47% market share, and the remaining $5.1 billion was adjustable rate. Fixed Rate HMBS issuance dropped from a 65% share last year, reflecting FHA’s changes to the HECM program.

Many of these pools will find their way into HREMIC securitizations; over 370 HMBS pools issued in 2013 have already been securitized (some partially) into HREMICs. HREMIC issuance, as we noted in our previous blog, fell off sharply in the fourth quarter of 2013, but HMBS issuance did not. In fact, HMBS issuance was distributed very evenly throughout the year.

The HREMIC market share of HMBS depends on the relative value of the HREMIC bonds, or classes, that are created from the cash flow of the underlying HMBS. Some investors are content to hold the HMBS itself, and earn premium interest over time. However, dealers often find it profitable to issue an HREMIC, in which HMBS serves as collateral for HREMIC bonds.

The HREMIC structure splits up the cash flow from an HMBS, or several HMBS, into two or more classes. Often this structure takes the form of a pass-through and an interest-only or “IO” class. The pass-through class typically has a par amount equal to the par amount of the underlying HMBS, but pays a lower interest rate. The IO is entitled to the excess interest, and is sold to another investor, often a hedge fund that is willing to bet on long duration. Basically, if the sum of the Pass-through price (typically at or near par) and the IO price (typically expressed as a multiple of the excess interest) exceeds the price of the underlying HMBS, HREMIC issuance may be the most profitable strategy.

In the fourth quarter of 2013, however, the bid for HMBS remained strong but the HREMIC bond bids faded, especially for the IOs. This is likely a short-lived market condition, and we do not foresee any long-lasting dislocation of the HREMIC market. In fact, HREMIC market share may even increase, to extent that new product changes add duration and thus relative value to IO classes.

New View Advisors compiled this data from publicly available Ginnie Mae data as well as private sources.