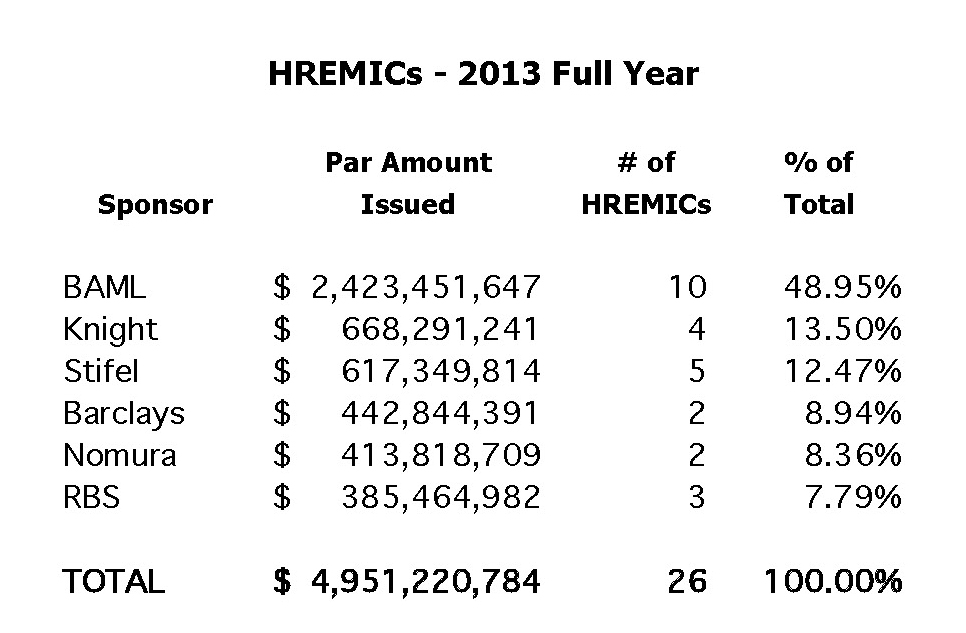

HREMIC issuance for all of 2013 was off 18% from 2012, with 26 transactions totaling $4.95 billion. In 2012, 31 transactions totaling just over $6 billion were issued. HREMIC issuance fell sharply in the fourth quarter, with only 3 HREMICs totaling $313 million. No HREMICs were issued in December 2013, marking the first month since October 2011 without a single new HREMIC.

Bank of America Merrill Lynch captured the issuance crown again in 2013 with 10 issuances totaling $2.4 billion. Knight Capital was second with 4 issuances totaling $668 million, and Stifel Nicolaus was third with $617 million. BAML is the #1 all-time issuer with 43 HREMICs for $9.8 billion. Among active issuers, Barclays is #2 with 23 HREMICs for $3.9 billion, and RBS is #3 with 7 HREMICs for $1.0 billion since the inception of the program.

HREMIC collateral consists of HMBS, which are Ginnie Mae guaranteed pass-through securities. HMBS are backed by pools of participations of HECMs, which are FHA-insured reverse mortgages. In other words, the HECM loans are the collateral for the HMBS, which in turn serve as the collateral for the HREMIC. This double layer of government guarantee, combined with the relatively high coupon and favorable prepayment patterns of the underlying loans, results in very favorable execution, even when compared to other Ginnie Mae “forward mortgage” securities.

New View Advisors compiled these rankings from publicly available Ginnie Mae data.