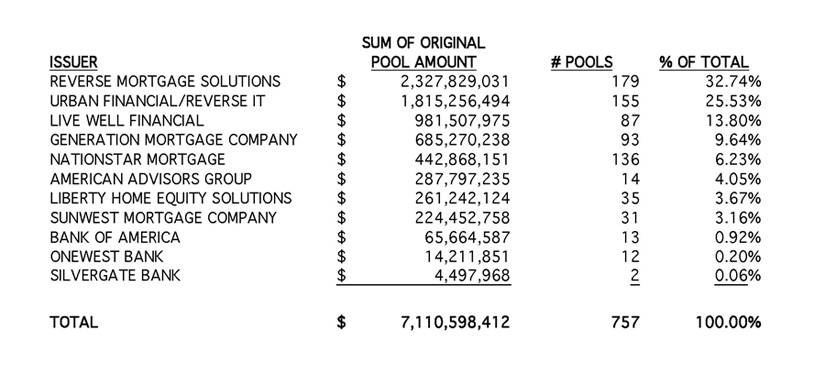

HMBS issuance totaled $7.11 billion for the first three quarters of 2013, with 757 pools issued. There are now 11 active HMBS issuers with the newest entrant AAG issuing 14 pools for nearly $288 million, more than 4% of all issuance and already sixth in the 9-months league table rankings. RMS continues its reign as the #1 issuer, with a total of 179 pools for $2.3 billion issued year to date. RMS issued 57 pools for $589.7 million in the third quarter, extending its lead over #2 issuer Urban, which sold 44 HMBS pools for $495.2 million in the third quarter. Live Well, Generation Mortgage, and Nationstar retained their positions as the number three, four, and five issuers respectively.

The number of HMBS pools issued in the third quarter was nearly identical to the second quarter, 257 versus 256, but dollar volume declined 13% to $2.2 billion, down from $2.5 billion. This reflects lower origination volume, but the onward increase of smaller “tail” issuance naturally occurring as servicing, MIP, borrower draws, and other advances continue to accrete on outstanding HECMs. Of the 757 pools issued, 288 or 38% are tails. Yet, tail issuance represents just 14%, or a little over $1 billion, in dollar volume.

Of the third quarter issuance, 43% or $950 million was fixed rate, the remainder both Libor and CMT adjustable rate HMBS. Year to date, fixed rate HMBS represents approximately 60% or $4.2 billion of total issuance, down from 67% or $3.3 billion in the first half.

New View Advisors compiled these rankings from publicly available Ginnie Mae data as well as private sources.