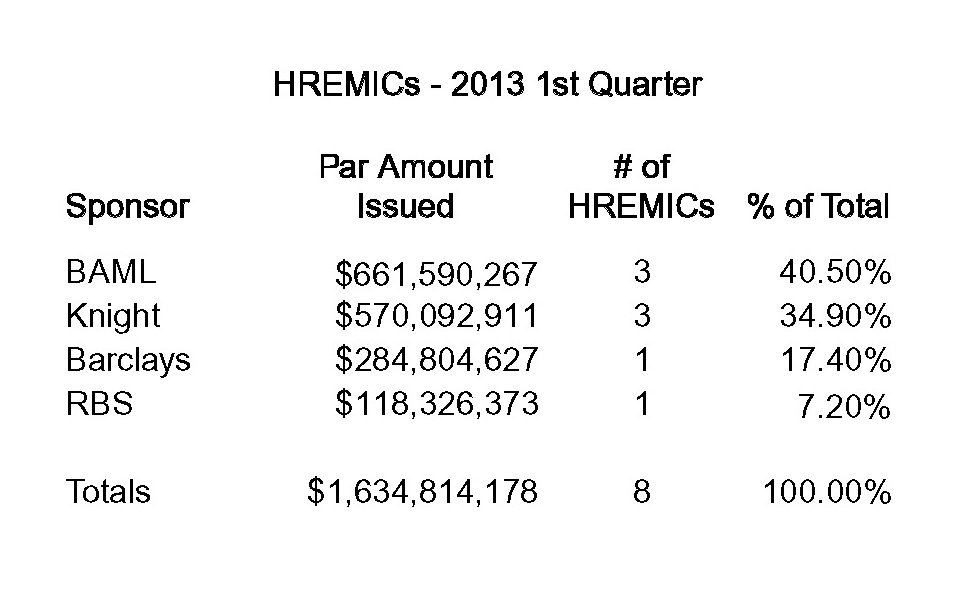

First quarter 2013 HREMIC issuance matched last year’s record pace, with 8 HREMICs totaling $1.6 billion, according to Ginnie Mae data. Last year, 31 HREMICs came to market, totaling just over $6 billion. BofA Merrill Lynch edged out Knight Capital for the top underwriter/sponsor in the first quarter of 2013, leading 3 offerings totaling just over $660 million. Knight followed close behind with 3 issues totaling $570 million. BAML has captured the top spot in all four of the annual rankings in 2009 through 2012. In fact, BAML has sponsored nearly half of all of the HREMIC volume ever issued.

Since the first HREMIC was issued in 2009, 91 transactions totaling over $16.4 billion have been issued. Despite the decline in reverse mortgage origination, new HREMIC origination far outstrips the paydowns of these bonds. The overall HREMIC float could top $20 billion as early as the 4th quarter of this year.

In the first quarter of 2013, HREMIC sponsors used a total of 186 unique HMBS pools (or portions thereof) to create 65 classes of bonds. In doing so, they securitized nearly half of the new HMBS pools issued thus far in 2013. Since 2009, over 1000 unique HMBS pools have been securitized into HREMICs; we estimate that at least 70% of all new HECM supply will eventually find its way into HREMICs. Most of the HREMICs issued this quarter are backed by HMBS pools issued in 2013 and the latter part of 2012, but some include HMBS collateral issued as far back as 2009.

HREMIC collateral consists of HMBS, which are Ginnie Mae guaranteed pass-through securities. HMBS are backed by pools of participations of HECMs, which are FHA-insured reverse mortgages. In other words, the HECM loans are the collateral for the HMBS, which in turn serve as the collateral for the HREMIC. This double layer of government guarantee, combined with the relatively high coupon and favorable prepayment patterns of the underlying loans, results in very favorable execution, even when compared to other Ginnie Mae “forward mortgage” securities.