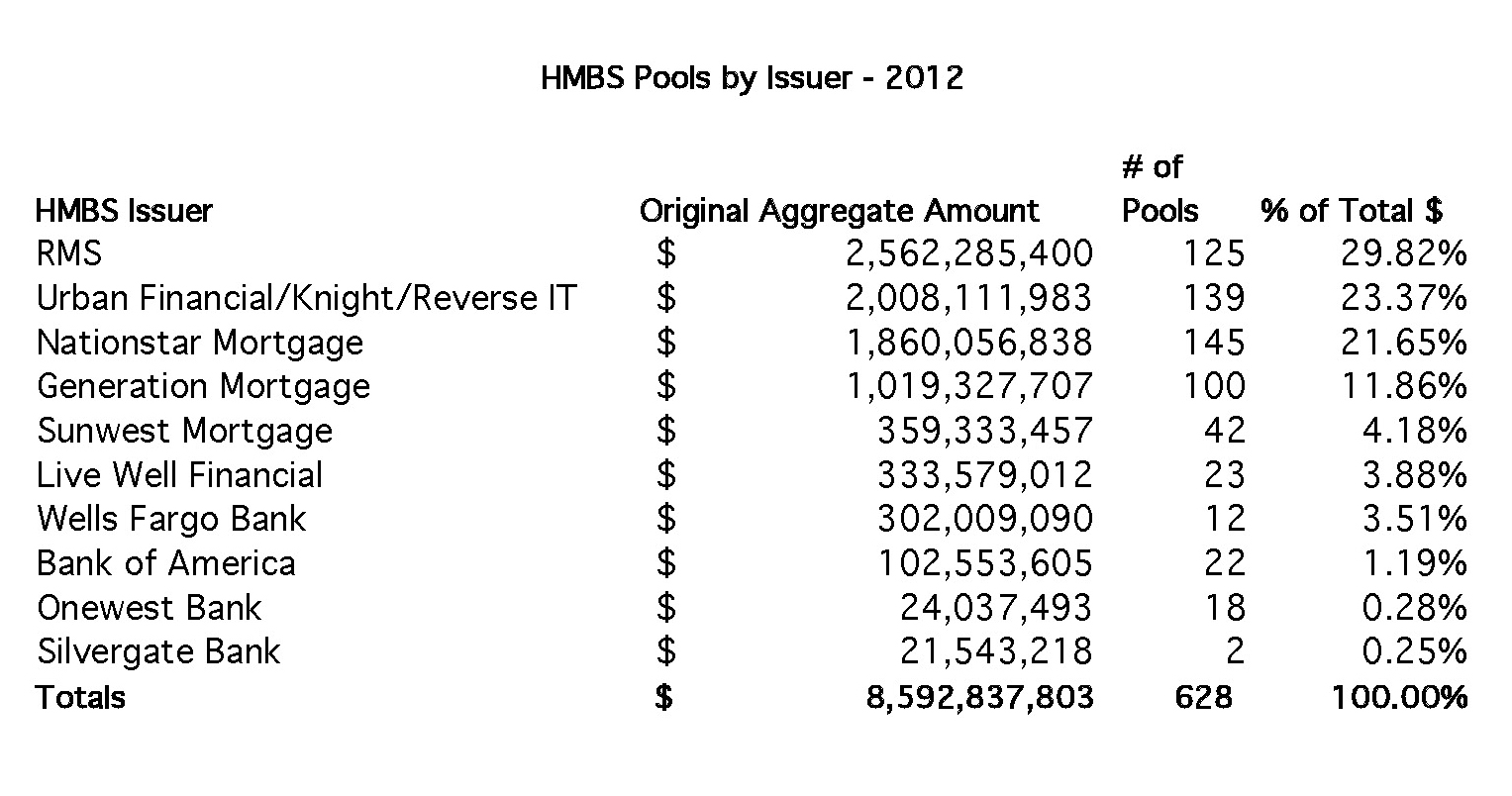

HMBS issuance declined for the second year in a row, tracking the decline in HECM supply. 628 HMBS pools totaling nearly $8.6 billion were issued in 2012, down from $9.9 billion last year and almost 20% below 2010’s record $10.7 billion. For 2012, RMS was the top HMBS issuer, issuing 125 pools totaling nearly $2.6 billion. RMS was followed by Urban Financial/Knight, Nationstar, and Generation Mortgage, issuers of approximately $2.0 billion, $1.9 billion, and $1.0 billion, respectively. Live Well Financial and Silvergate Bank both joined the ranks of HMBS issuers in 2012. Overall, ten firms issued HMBS in 2012, of these, 4 are legacy issuers that do not currently produce or purchase new HECM production.

Of the $8.6 billion in 2012 issuance, $5.6 billion was fixed rate and the remaining $3.0 billion was adjustable rate. 350 of the 628 pools were securitizations of new production, and the remaining 278 pools were “tails,” that is, securitization of additional amounts, such as credit line draws, fixed term and tenure payments, and MIP payments that are added to HECM balances over time. Because of tail issuance, 2012 issuance did set a record for number of pools, topping the 498 and 473 pools issued in 2010 and 2011, respectively.

The vast majority of these pools will find their way into HREMIC securitizations, and over 350 HMBS pools issued in 2012 have already been securitized (some partially) into HREMICs.

New View Advisors compiled this information from publicly available Ginnie Mae data as well as private sources.

*Full Credit Given to Acquiring Issuer.