HMBS payoff speeds decreased in November; Mandatory Purchases and natural payoffs were 10.0% and 6.1% per annum, respectively. November payoffs totaled about $825 million. Outstanding HMBS increased slightly and remains just under $59 billion.

As mentioned in previous blogs, Ginnie Mae took over RMF’s HMBS portfolio last December. “Ginnie Mae – Reverse Mortgage Funding 42” remains as issuer of record for 4,033 former RMF pools. About $301 million of Issuer 42’s portfolio paid off in November, but Issuer 42 still accounts for $18.3 billion, or about 31% of all outstanding HMBS. Issuer 42 has not issued any tail pools; we estimate Issuer 42 now has well over a $1 billion uncertificated position, that is, the excess of the portfolio’s HECM asset balance over the balance of its HMBS liability.

When a HECM loan balance reaches 98% of its MCA, the HMBS issuer is required to buy the loans out of the HMBS pool, and then may assign the loan to HUD if the loan is not in default. This is a prepayment event for the HMBS investor, even though the underlying HECM loan remains outstanding. According to our friends at Recursion, 62% of HMBS payoffs last month were due to Mandatory Purchase, totaling about $512 million, a decrease from last month’s $531 million, but remaining above the average for the prior 10 months of 2023 ($496 million per month) and all of 2022 ($315 million per month).

Including the Mandatory Purchases, HMBS paid off at a 16.1% annual rate in November, and 16.9% over the last 12 months. Exclusive of Mandatory Purchases, the rate of HMBS payoffs has fallen significantly over the past 12 months. Natural payoffs (those other than Mandatory Purchases) for the 12 month period ending November 30th were 7.4% per annum, compared to 15.2% for the prior 12 month period.

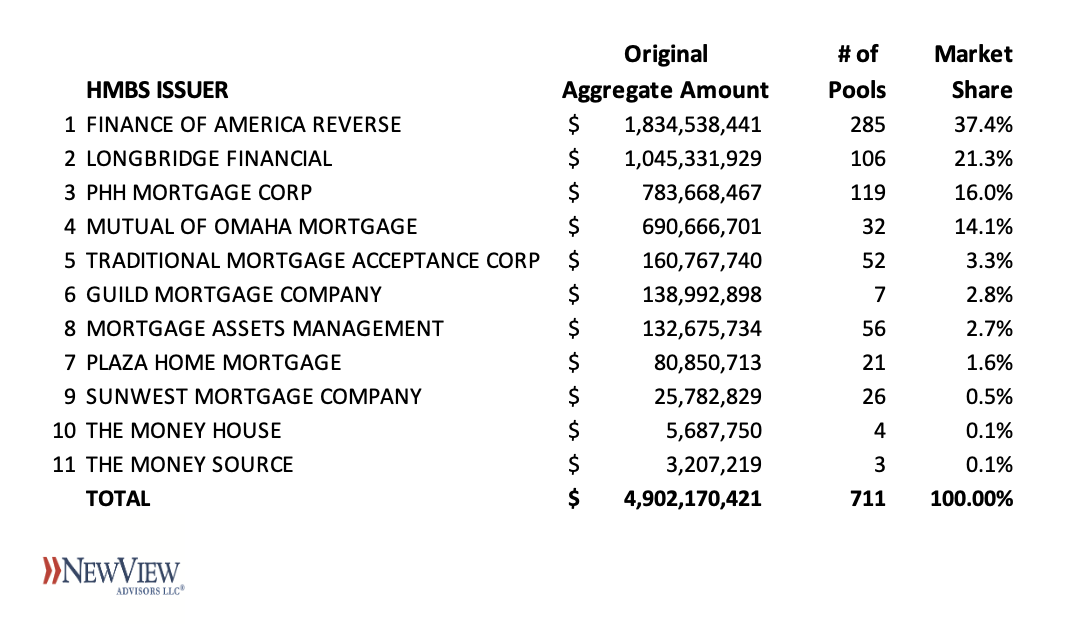

New View Advisors compiled this data from publicly available Ginnie Mae data as well as private sources.